Your Personal Investment Vault

|

If you want one single metric to measure your financial success in life, this is it: your Personal Investment Vault. Within the Vault resides all of the liquid assets (savings, IRAs, company retirement plans) you will use to create your desired income stream upon "retirement." We put that word in parenthesis because it should not be something you automatically hit at a certain age; rather, it will be something that happens when your Personal Investment Vault is large enough to effectively provide your desired monthly income stream.

So, how big does your Vault need to be? That depends. If you want a passive income stream of $10,000 each month, then your Vault needs to contain $2.4 million worth of assets. In other words, for each $1 million worth of assets, your Vault can provide you an income stream of $50,000 per year, and give you a "cost of living" increase each year. So, if you can answer only one financial question, it should be this: How big is your Investment Vault right now? |

|

Funding Your Vault

So, now that we have defined the single most important metric to your financial success, let's discuss how we get you to that point from where you are right now as efficiently as possible.

There is power in simplicity, and just as you will distill down your goals to one specific number, let's define the one simple rule you must follow to assure you get there: The First Ten Cents of Every Dollar You Earn Goes Into Your Investment Vault." I first came across this straightforward maxim as a teenager. I was somewhat of an odd duck; I got massive enjoyment out of reading financial publications and books dealing with "all things money." I studied great investors like Peter Lynch and Benjamin Graham to see what they were doing differently than the pack.

One afternoon, while looking through my local library's wealth and finance section, I noticed a small little dog-eared book entitled "The Richest Man in Babylon." First written in 1926 by insurance salesman George Clason, the book is set in ancient Babylon, and provides a set of parables designed to create wealth. One of those lessons was: "For every ten coins earned, spend but nine." The other coin—actually, the first—was to be put to work building up your own personal wealth. Simple? Yes. Effective? Enormously! But you must always use this 10% rule, and never go in and raid your Vault for current living expenses—that is what the other 90% is for! |

It took a national lockdown, but the US savings rate hit a new record

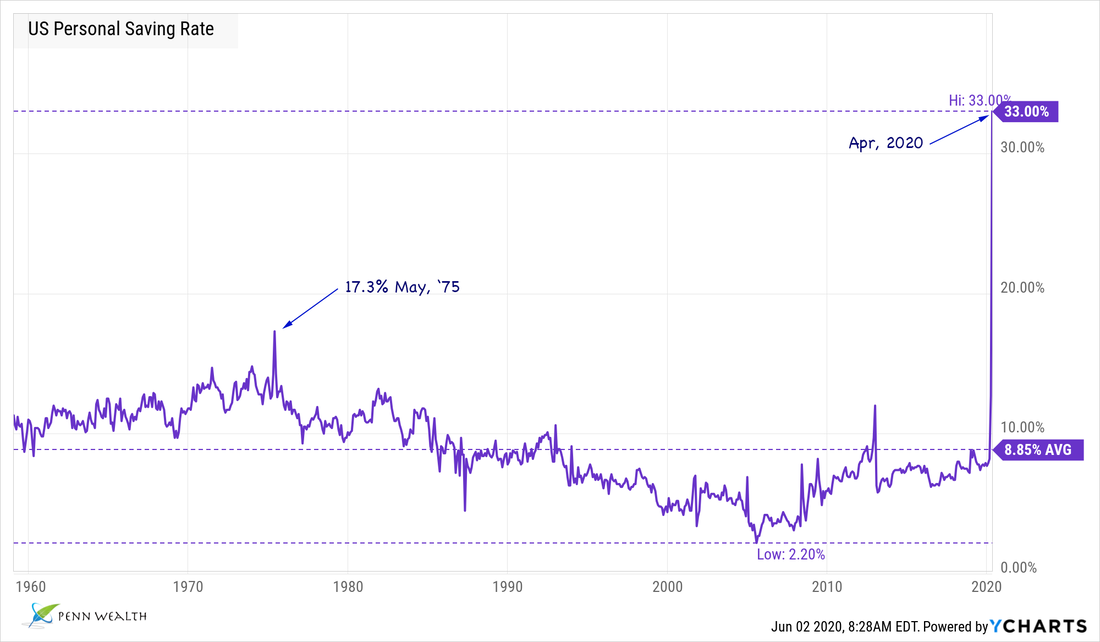

(02 Jun 2020) If we have one mantra, one financial maxim above all others, it is this: The first ten cents of every dollar you earn goes into your savings/investment "vault," and that money is not to be touched until you have enough to fund your desired lifestyle with a 5% per year withdrawal. Unfortunately, Americans have one of the lowest savings rates in the developed world. Until this past April, that is. According to the Bureau of Economic Analysis (BEA), the personal savings rate—the percentage of disposable income Americans save each month—hit a whopping 33% in the month of April. As you look at the chart and see the 8.85% average, keep in mind that the figure does not mean Americans save an average of 8.85% of their gross or net income—merely their disposable income. Yes, the US consumer accounts for two-thirds of the domestic economy (and much of the Chinese economy), but imagine what household wealth would look like if everyone did actually put 10% of even their net income to work in an investment plan. Perhaps then we could begin to tackle our $1 trillion worth of lingering credit card debt and $1.5 trillion worth of student loan debt. It is not the duty of the American consumer to support retailers, domestic or foreign; it is their duty to assure the fiscal solvency of their household.

(02 Jun 2020) If we have one mantra, one financial maxim above all others, it is this: The first ten cents of every dollar you earn goes into your savings/investment "vault," and that money is not to be touched until you have enough to fund your desired lifestyle with a 5% per year withdrawal. Unfortunately, Americans have one of the lowest savings rates in the developed world. Until this past April, that is. According to the Bureau of Economic Analysis (BEA), the personal savings rate—the percentage of disposable income Americans save each month—hit a whopping 33% in the month of April. As you look at the chart and see the 8.85% average, keep in mind that the figure does not mean Americans save an average of 8.85% of their gross or net income—merely their disposable income. Yes, the US consumer accounts for two-thirds of the domestic economy (and much of the Chinese economy), but imagine what household wealth would look like if everyone did actually put 10% of even their net income to work in an investment plan. Perhaps then we could begin to tackle our $1 trillion worth of lingering credit card debt and $1.5 trillion worth of student loan debt. It is not the duty of the American consumer to support retailers, domestic or foreign; it is their duty to assure the fiscal solvency of their household.

Over half of Americans have less than $1,000 in savings. (25 Jul 2018) Do you get depressed when you look at your investment and savings accounts? This may make you feel a bit better. According to a GoBankingRates.com survey, nearly 60% of Americans have less than $1,000 in savings, and only 25% have over $10,000 they could get their hands on. Drilling down a bit deeper into the low-end numbers, 39% of Americans have nothing saved for retirement. No doubt, a big factor in this has been the proliferation of consumer credit in the country. When an emergency strikes, but there is nothing in the savings account and all of that would-be discretionary income is needed to pay the credit card bills, where do Americans turn? To the credit cards that caused the problem in the first place. And while the Baby Boomer generation placed better on the survey, all of the other generations—basically aged 60 on down—are relatively in the same dire situation. Last year, the aggregate credit card debt of Americans surpassed $1 trillion. A few years earlier, sadly, the aggregate student loan debt of Americans surpassed $1 trillion.