Emergency Reserve Fund

No financial plan is set in stone. You never know when an emergency will arise requiring immediate funds to resolve. This could run the gamut from unexpected health expenses to a loss of employment. Of course, you would not want to be forced to put such expenditures on a credit card or take an early withdrawal from a retirement account, so you must have funds readily available for such purposes.

How much should you have on hand? The general rule of thumb is to have enough cash to completely cover all expenses—rent or mortgage, debt payments, utilities, groceries, and any other recurring payments—for a three- to six-month period. Ideally, you should have a separate account set up dedicated to this: your Emergency Reserve Fund.

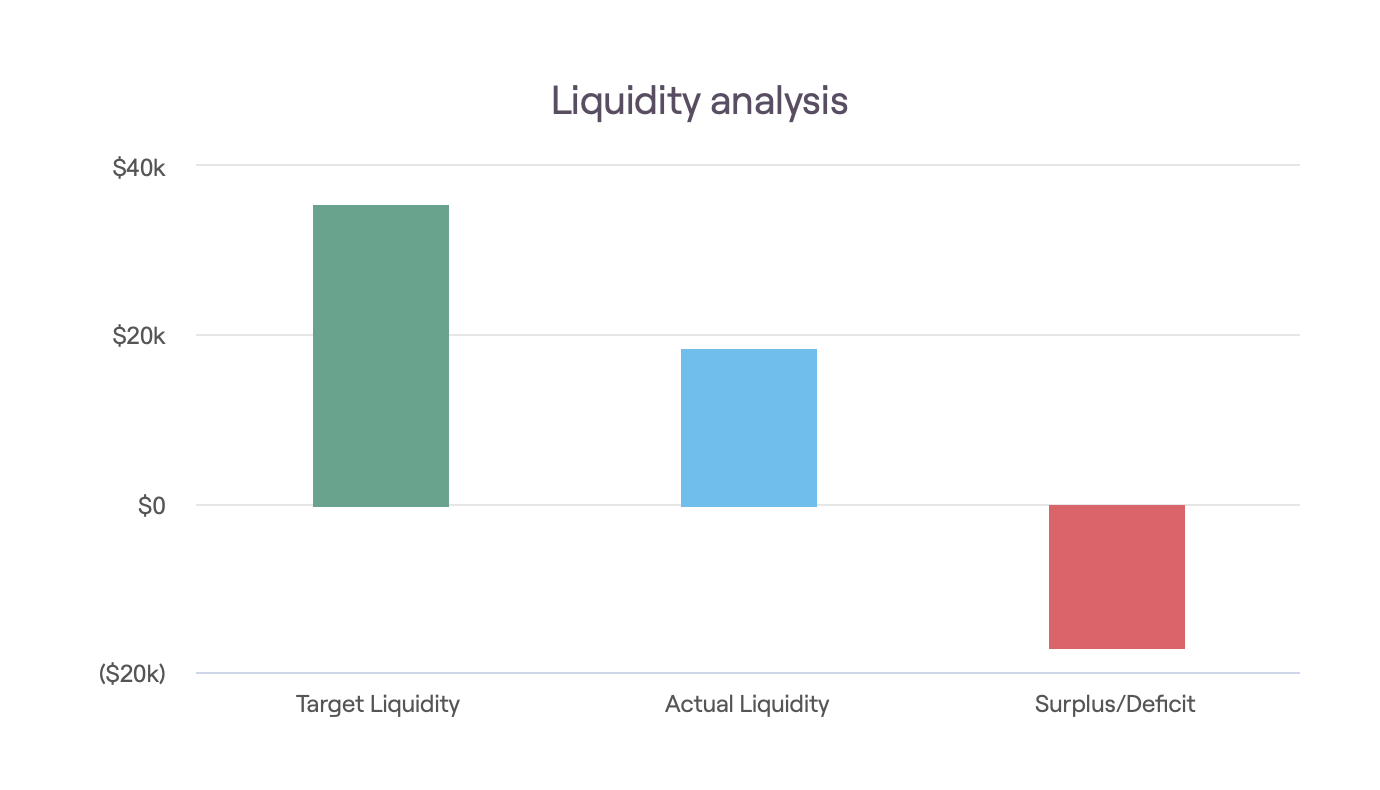

All clients of Penn Wealth have easy access to view the funds available in their Reserve Fund. By navigating about halfway down the home page Snapshot screen, you will see a tile called Liquidity Analysis. Hovering over this tile will bring an upward-facing arrow into view. Select that arrow to be taken to the Liquidity Analysis section of your Personal Financial Website. Here you will find a graph of your target liquidity, actual liquidity, and any surplus or deficit. Below the graph, in the Action Items section, you can adjust your target and proposed expense buffer to a level you are comfortable with. By selecting the Details tab, you will see a list of your current monthly expenses in one column, and the accounts in which your emergency funds reside in another column. You should always be aware of your total current liquidity, and work to maintain an appropriate amount of liquid assets.

How much should you have on hand? The general rule of thumb is to have enough cash to completely cover all expenses—rent or mortgage, debt payments, utilities, groceries, and any other recurring payments—for a three- to six-month period. Ideally, you should have a separate account set up dedicated to this: your Emergency Reserve Fund.

All clients of Penn Wealth have easy access to view the funds available in their Reserve Fund. By navigating about halfway down the home page Snapshot screen, you will see a tile called Liquidity Analysis. Hovering over this tile will bring an upward-facing arrow into view. Select that arrow to be taken to the Liquidity Analysis section of your Personal Financial Website. Here you will find a graph of your target liquidity, actual liquidity, and any surplus or deficit. Below the graph, in the Action Items section, you can adjust your target and proposed expense buffer to a level you are comfortable with. By selecting the Details tab, you will see a list of your current monthly expenses in one column, and the accounts in which your emergency funds reside in another column. You should always be aware of your total current liquidity, and work to maintain an appropriate amount of liquid assets.

|

06 Jun 2023

|

With cash equivalent rates at a decade-long high, it is time to revisit your emergency reserve funds

I recall talking with a prospective client back around 2002. After reviewing their retirement plan—the largest asset outside of their home—I asked, “I noticed you’re only putting away 3% in your 401(k) even though your company matches the first 6% of contributions; why is that?” His answer: “What’s the point? Whatever I put in there just goes down.” I thought back to that comment when reviewing an article on the current—abysmal—state of the average American’s emergency savings fund. Proper financial planning tells us that we should have enough cash on hand to pay three to six months’ worth of living expenses—rent or mortgage, utilities, groceries, debt payments, etc.—in case of a fiscal emergency such as job loss. Shockingly, over 50% of respondents to a recent poll said they don’t have any emergency savings at all. Approximately 25% said they have between $1,000 and $3,000 squirrelled away for this purpose, leaving just 25% with minimum required amounts or more. Several years ago I had a client question why they had so much money “sitting in cash” in their account. I told them that they must view cash equivalents as an asset class, and one which should never be ignored. Their retort was that cash wasn’t making them anything. Now, after ten rate hikes, that excuse no longer holds up. With money markets, short-term CDs, and T-bills yielding around 5%, it is time to review your Emergency Reserve Fund (ERF). While this can include cash sitting in investment accounts, co-mingled with stocks and bonds, we recommend having one dedicated account for this purpose. With no-cost brokerage accounts (we custody our funds at TD Ameritrade and Schwab, primarily), there are no irritating account maintenance fees to deal with any longer. If your financial institution charges such fees for the “honor” of having an account, consider opening them elsewhere. Even Apple (APPL $179) is getting in on the action, with Apple Pay’s new automatic savings account (currently) earning 4.15%. The current yield on the Schwab Value Advantage Money Fund which we use in client accounts is 4.92%, up from 0.04% just a year ago! The fund has daily liquidity at $1 per unit—an important condition for your ERF account. As for monitoring your emergency fund, this is a figure you should have at your fingertips. All clients and members of Penn Wealth have a secured Personal Financial Website which outlines their liquidity, via both a graph showing target amount and any surplus or deficit, and an informational table which details where the cash is sitting. Whatever method you use, don’t neglect this important aspect of your overall financial plan. Clients and members can locate their emergency savings information by going to their Personal Financial Website, navigating about halfway down the page to the Liquidity Analysis tile, and selecting the upward-facing arrow visible when hovering over the area. Not a client or member? Contact us for more information. |