Science & Technology Investor

Reprinted from The Penn Wealth Report, Vol. 7 Issue 02, From the Editor

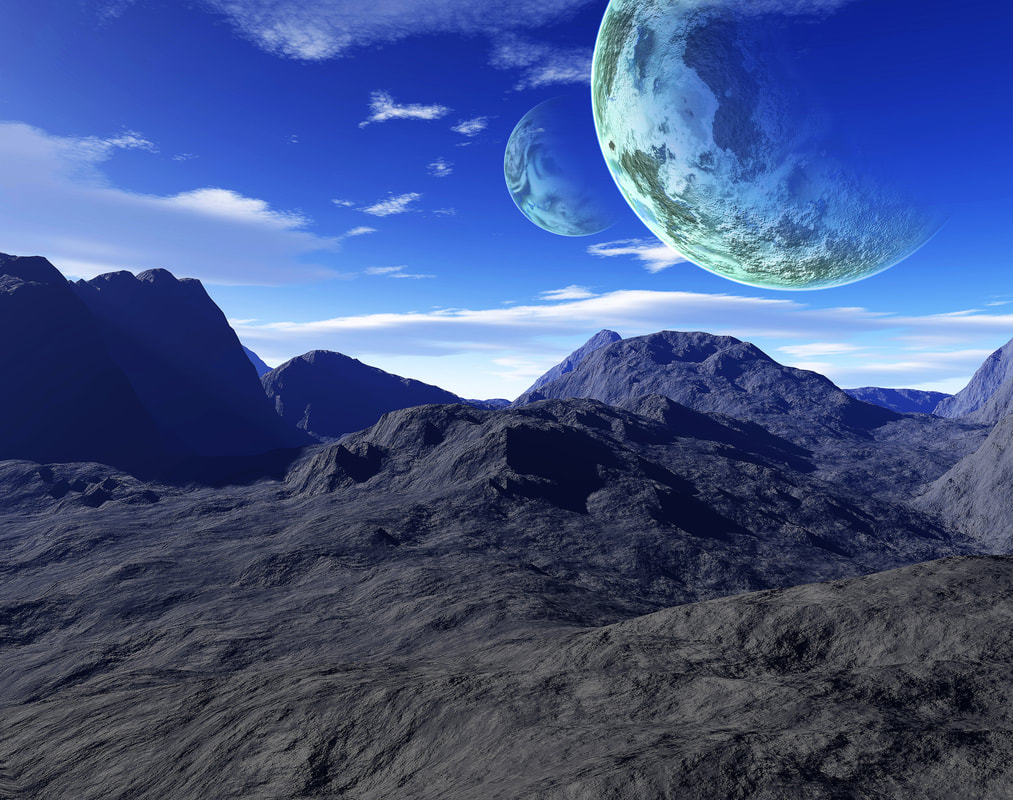

(Photo Courtesy of SpaceX)

Staying on the Lookout for the Technologies of the Future

We may look back and kick ourselves for not investing in the likes of Apple, Microsoft, and Oracle a generation ago. Don’t fret: a slew of exciting new industries will soon create similar opportunities.

Probably the most exciting—and most overlooked—Penn strategy is our New Frontier Fund. Searching for new entrants to this vehicle can be a rush, though it is fraught with danger. We are on the constant lookout for viable companies on the cutting edge of science and technology. Not that penny stock your buddy has “inside information on,” but the real companies, generating real income, creating the products and services that will lead us into the future.

The New Frontier Fund was on my mind as I was watching the first-ever launch of the SpaceX Crew Dragon sitting atop a Falcon 9 rocket, powered by 9 Merlin engines. The virtually flawless launch, and subsequent docking of the Crew Dragon to the International Space Station, gave me goosebumps. It was an inspiring sight, reminiscent of the launches I used to watch as a kid. The exciting events produced by NASA before that agency was gutted, for all intents and purposes, by a president who shall not be named. You can come to your own conclusions (we did) as to why this person spat in the face of John F. Kennedy by slashing the NASA budget and perverting its mission, but that is in the past. The agency is back with a vengeance, armed with new missions and new partners from the private arena. From plans for stations on the lunar surface, to a new US Space Force, to a manned trip to Mars, America has regained the mantle as the world’s space exploration superpower. It is a disgrace that it was ever given up.

Think back to the nascent stages of the personal computer revolution and the ability we suddenly had to tap into an amazing new creature called the Internet. These were the movements which transformed our lives, and the investment landscape. Seemingly overnight, new technology names like Microsoft, Oracle, and Apple took over the mantle of leadership from old industrial heavyweights like General Motors and General Electric. Others, like Yahoo, flew sky-high and then crashed to earth.

It is important to study the past generation of new tech investments, because we believe the same type of revolution (or, at least, radical evolution) is about to occur in areas such as space travel, artificial intelligence, medical sciences, and power generation (forget wind and solar; think hydrogen and biofuels). For astute investors, opportunities will abound. Of course, for every wild success story there will be a dozen flounders. The key is doing the research.

But fear not, this thesis provides the backdrop to the Penn New Frontier Fund. Over the coming months, we will build-out new science and technology platforms and pages on our sites and within our publications. Here’s to vibrant and exciting times ahead!

—MSH

(Photo Courtesy of SpaceX)

Staying on the Lookout for the Technologies of the Future

We may look back and kick ourselves for not investing in the likes of Apple, Microsoft, and Oracle a generation ago. Don’t fret: a slew of exciting new industries will soon create similar opportunities.

Probably the most exciting—and most overlooked—Penn strategy is our New Frontier Fund. Searching for new entrants to this vehicle can be a rush, though it is fraught with danger. We are on the constant lookout for viable companies on the cutting edge of science and technology. Not that penny stock your buddy has “inside information on,” but the real companies, generating real income, creating the products and services that will lead us into the future.

The New Frontier Fund was on my mind as I was watching the first-ever launch of the SpaceX Crew Dragon sitting atop a Falcon 9 rocket, powered by 9 Merlin engines. The virtually flawless launch, and subsequent docking of the Crew Dragon to the International Space Station, gave me goosebumps. It was an inspiring sight, reminiscent of the launches I used to watch as a kid. The exciting events produced by NASA before that agency was gutted, for all intents and purposes, by a president who shall not be named. You can come to your own conclusions (we did) as to why this person spat in the face of John F. Kennedy by slashing the NASA budget and perverting its mission, but that is in the past. The agency is back with a vengeance, armed with new missions and new partners from the private arena. From plans for stations on the lunar surface, to a new US Space Force, to a manned trip to Mars, America has regained the mantle as the world’s space exploration superpower. It is a disgrace that it was ever given up.

Think back to the nascent stages of the personal computer revolution and the ability we suddenly had to tap into an amazing new creature called the Internet. These were the movements which transformed our lives, and the investment landscape. Seemingly overnight, new technology names like Microsoft, Oracle, and Apple took over the mantle of leadership from old industrial heavyweights like General Motors and General Electric. Others, like Yahoo, flew sky-high and then crashed to earth.

It is important to study the past generation of new tech investments, because we believe the same type of revolution (or, at least, radical evolution) is about to occur in areas such as space travel, artificial intelligence, medical sciences, and power generation (forget wind and solar; think hydrogen and biofuels). For astute investors, opportunities will abound. Of course, for every wild success story there will be a dozen flounders. The key is doing the research.

But fear not, this thesis provides the backdrop to the Penn New Frontier Fund. Over the coming months, we will build-out new science and technology platforms and pages on our sites and within our publications. Here’s to vibrant and exciting times ahead!

—MSH

Space Sciences & Exploration |

|

The Loup Frontier Tech ETF

(02 Sep 2018) A new thematic investment focused on the disruptive companies that will help shape the future of technology. (Members: Read the article in The Penn Wealth Report by selecting button to the right) |